Advanced Management System

Finding success in the automotive and finance industries means finding software that can handle all of your business’ needs. Advanced Management Systems (AMS) has provided this technological edge for companies nationwide since 1983. With a client base ranging from car lots to pawn shops and title loans to rent-to-own, AMS provides a fully integrated environment that streamlines your everyday operations. Designed specifically for the sub-prime financiers and Buy Here Pay Here dealers handling everything from revolving credit and consumer loans to used car sales and securitization, this UNIX® based software solution will transform your operation into a peak performer. As an IBM Business Partner®, AMS combines superior software with the unmatched IBM® RS6000 RISC Platform. AMS specializes in large operations with over 15,000 users and over $1B in receivables in the following automotive related industries: Sales Companies, Leasing Companies, RFC Companies, Finance Companies, Title Loan Companies, Rent-To-Own Companies, Floor Plan Companies, Rental Companies, Consumer Loan Companies, and Loan Processing Companies with fully integrated Accounting & Payroll.

Deal Pack® is a complete Dealer Management and Loan Servicing Software designed for BHPH dealerships and subprime finance companies. Deal Pack offers fully integrated sales, leasing, finance, rental, and service modules with real-time accounting and industry-leading collections. All modules, including accounting, are fully integrated. Deal Pack accounting is specialized for the subprime finance industry and capable of over 150,000 accounting entries specific to subprime finance – incomparable to any other accounting software. Deal Pack is customizable to your exact needs and scalable to your exact size – providing precisely what you need and helping consolidate software vendors. Deal Pack services public and private companies of all sizes nationwide, including independent automobile dealerships, budget lots of franchise dealerships, buy here pay here dealerships, lease here pay here dealerships, multi-entity companies, finance companies, related finance companies, and service departments. Operating and capital leases, internal and external floor-planning, rentals, consumer loans – Deal Pack handles it all. Customers properly using Deal Pack have never lost an IRS audit. To learn more, visit www.dealpack.com.

Deal Pack Service & Parts handles your service department and is fully integrated with the entire Deal Pack ecosystem. The benefits of using Deal Pack in both the dealership and service departments are vast, especially from an accounting perspective. For example, any parts order or repair work in Service updates costs in Sales/ inventory, while also updating general ledger and subsidiary reports. Deal Pack Service & Parts provides text messaging and voice broadcasting features, as well AllData integration for labor guides. Manage appointments, parts, repair orders, part sales, accounting, and tech logs all in one system.

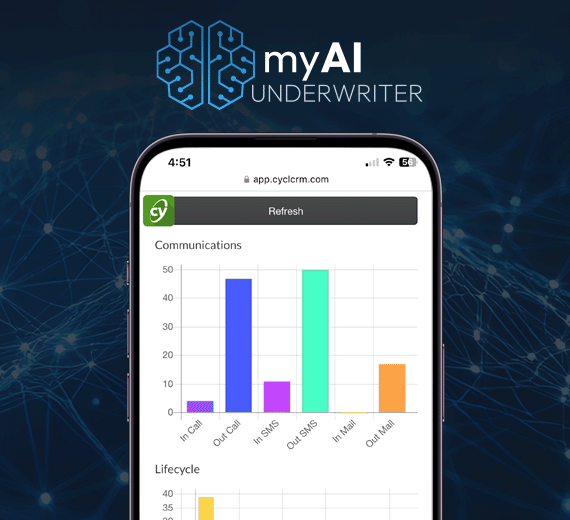

cyclCRM is the only customer relationship management (CRM) solution built specifically for the Buy-Here-Pay-Here used car industry and completely integrated (bi-directional) with the dealer management software (DMS) and loan management software (LMS). cyclCRM transcended the traditional boundaries of a CRM because ABCoA listened to customers' needs and extended its benefits to dealers and lenders. cyclCRM is a single application providing customer relationship management (CRM), loan origination software (LOS), and an instant funding portal called Capsa. cyclCRM works as one with the DMS and LMS to enhance operations and eliminate friction in the customer experience, dramatically improving profits and processing time with fewer staff. To learn more, visit www.cyclcrm.com.

Capsa is the most cost-efficient platform for used car dealerships to connect to auto lenders in real-time with automated decisioning and secure data transmission. Capsa provides preapprovals and instant funding for point of sale, seasoned, or portfolio purchases, floorplans, and consumer loans, enabling lenders to fund deals in real-time. For sellers (dealers), Capsa takes the consumer's credit app, or complete deal information from the integrated DMS, and broadcasts it to buyers (lenders). Within Capsa, the seller can view multiple buyers' terms in one place. Conversely, the buyer can view deals from sellers that meet its lending criteria, and can accept the deal, modify terms, or reject the deal entirely. When a deal is accepted, Capsa securely transfers all information, including electronic documents and stips stored in their Digital Document Vault, from the seller's DMS to the buyer's LMS. Capsa works as one with the DMS and LMS to enhance operations and eliminate friction in the customer experience, providing users incredible performance improvements.

DST Dealership Sales Tools is a browser-based dealer management software (DMS) for retail used car dealerships providing unlimited users and locations for $1 per deal. Manage inventory and prospects, desk retail installment, cash, wholesale, rentals, and lease deals, e-sign and digitally vault contracts, attain funding and upload deals to finance companies, and much more in a cutting-edge DMS offering modern mobility and transaction-based pricing. DST offers the best features and best price in the industry for dealerships who do not need built-in accounting or collections in their DMS. For more information, visit www.dstdms.com.

DLJ Digital Loan Jacket Document Vault provides secure, integrated storage of electronic documents and media and unrivaled peace of mind. Stored securely in the cloud and available across all products - DLJ provides centralized document storage and media hosting, while reducing cost and increasing reliability. DLJ serves as the repository of your files and syndicator of your digital assets. Integrated with DocuSign, DLJ provides users the ability to electronically sign forms and store fully executed documents safely and securely on the cloud for effective future recall.

AI Collections / AI Sales

Streamline sales, collections, compliance, and more. myAI is a suite of intelligent automation tools that transform how finance and sales teams collect payments, follow up on leads, and underwrite loans. The suite includes AI Collector, AI Salesman, and AI Underwriter. myAI responds instantly and consistently, in any language, at any scale, across text, voice, WhatsApp, and email. Whether it’s reducing delinquencies, closing more leads, or making smarter lending decisions, myAI boosts revenue, reduces costs, and improves customer experience.

Collect recurring and one-time payments using our proprietary eAutoPayment portal. eAP provides omni-channel payment processing solutions – digital, physical, and contactless – to improve collections, increase customer loyalty, and reduce delinquency. Borrowers can make credit/debit card, ACH/eCheck, and cash payments online, over the phone, via text message, in-store, and off-site. Payments can be scheduled with custom rules and notices. Automate enrollment and send multi-factor, one-time payment links via text or email to take customers directly to payment without remembering login or account information. Collect payments using an IVR (Interactive Voice Response) system managed by ABCoA, allowing inbound payments to be made over the phone using automated prompts or automatic outbound payment reminder calls to also collect payment. Accept cash payments in-store, using payment kiosks, and at off-site locations, such as Walmart, Kroger, and CVS Pharmacy. eAP provides competitive rates and the shortest time until money is deposited in your account, oftentimes at zero-cost to you the lender.

Concord BI Subprime Analytics aggregates all your data in one platform for unrivaled Business Intelligence. Our users have the competitive advantage with intelligence never before offered. Our automotive expertise traces back to 1983. With enterprise-class web analytics, we help you monitor the relevant activity on and off your lot as it is happening - providing the insights and data you need to stay competitive in real-time. Better data means better decisions. Dynamic visual charts and customizable dashboards redefine inventory, sales, and collections data. Flexible reporting, for a single rooftop or entire automotive group, drives performance by providing actionable insights. Aggregate data across all your systems and forecast what’s next with machine learning that gets smarter with each transaction.

Let ABCoA host your website with integrated credit app, chat, and calendar for fully integrated sales, service department, and payment processing. For dealerships interested in selling more cars, a custom website promotes your dealership and syndicates your inventory. Eliminate duplication of effort to advertise online; manage your website, add inventory, upload photos, and edit listings in one place. ABCoA functions as the hub for your online listings and inventory management: Host your media, ensure consistency, and reduce IT costs by automatically updating inventory information and photos to all sources in real-time, including your website and third-party classifieds.

The refinement of ABCoA’s Total Solution is the result of direct involvement by an elite group of executives, CPAs, financial officers, and professional managers with BHPH and Auto Finance operations. Advanced Business Computers of America (ABCoA) is a tremendous resource offering expertise, consulting, and helpful tips on how to maintain greater control of your BHPH or Finance Company operations to achieve better efficiency, better collection, and profitability. With ABCoA’s years of industry expertise, we are poised to help you perfect your technique, timing and control. At first glance, ABCoA may appear to be in the business of selling software. Let there be no doubt, ABCoA’s product is service. Since 1983, our clients will tell you that ABCoA’s prosperity is attributable to one simple notion – to provide the highest quality of service available in the industry.